Problem Statement

Nestle Carnation Instant Breakfast Powders and RTD (ready-to-drink) products were losing market share within the rapidly growing instant protein breakfast category. Additionally, consumer retention was decreasing. While Nestle believed they had a firm grasp on their audience, Hyde Park Group was hired to find innovative ways to rejuvenate customer appeal using existing products.

Research Objectives

In order to stay ahead of the product innovation lifecycle, Nestle needed a deeper understanding of where consumer behavior is today and where it is going. By understanding consumer behavior, as well as further investigation into product sentiment with existing consumers, Hyde Park Group will be able to provide the proper solution for product innovation.

My Role

As lead researcher and project manager, I was responsible for analyzing market reports, planning field research, managing consultants (chefs), as well as planning and facilitating focus group sessions.

Research Methods

Primary Research

- Focus groups

- First-hand research of sentiment value through the use of multi-variant recipe testing.

- 5 focus groups

- 7-10 participants per group

- First-hand research of sentiment value through the use of multi-variant recipe testing.

Secondary Research

- Market Research

- Analysis of sales and consumer reports from third-party market research companies (Neilson Insights, IRI)

- Field Research

- 20 local grocery stores analyzed by type (national chains, local chains, corner markets, etc.)

- Inventory tracking and analyzing of competitive cost comparison.

- Observational study of consumer buying behavior.

- 20 local grocery stores analyzed by type (national chains, local chains, corner markets, etc.)

Timeframe

2 months

Primary Research

Persona

Primary Buyer: Gen X (Early Gen Y) Caregivers

We contracted a third-party recruiting company to screen and recruit participants that closely aligned with the persona description provided by Nestle.

Focus Groups

Planning Stage

I worked with a variety of consultants (2 professional chefs, 1 amateur chef) 2 weeks before focus group sessions to provide product inventory. I assigned tasks (recipe development) and deadlines to each consultant and then met with them the day before focus groups to do dry run-throughs of recipe creation on-site.

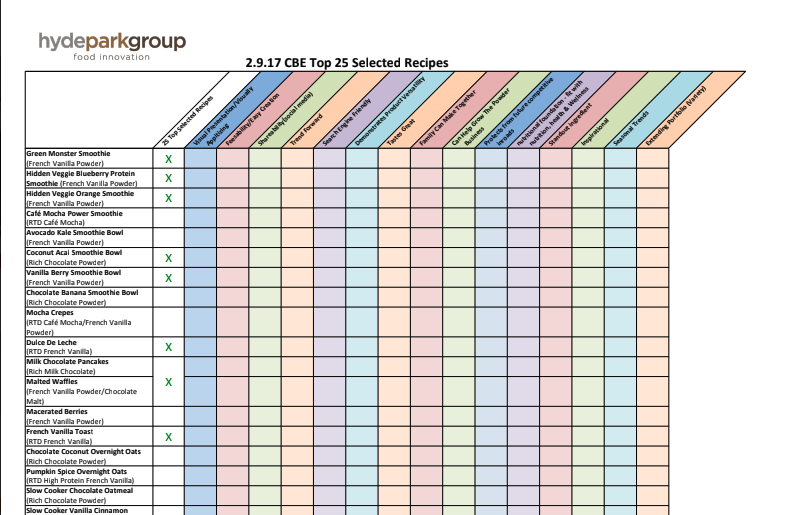

Recipes were grouped into multiple concept themes that closely aligned with consumer buying trends.

Execution Stage

We did a total of 5 focus group sessions, 1 focus group per day. Each session took 5 hours split into 2 segments.

- Segment 1 (Product Testing Matrix)

- A blind taste test of Nestle products alongside similar competitor products.

- Each participant recorded their score (likert scale) with a section to capture additional notes.

- After blind taste test was concluded we had a 1 hour group discussion regarding participant results and any feedback they wanted to share.

- Segment 2 (Recipe Testing Matrix)

- Recipe development tasting, all using Nestle products; 49 recipes total.

- Participants used the same likert scale to record their score and any comments.

- After blind taste test was concluded we had a 1 hour group discussion regarding participant results and any feedback they wanted to share.

Analysis Stage

After all focus groups were completed, I worked with my team to analyze the top recipes for segment 1. Recipes were narrowed down from 49 to 25 final recipes.

We also grouped participant feedback into themes from segment 2 that closely aligned with Nestle focus areas. The results from these findings were used for our final report to Nestle, along with our market research findings.

Secondary Research

Market Research

Field Study

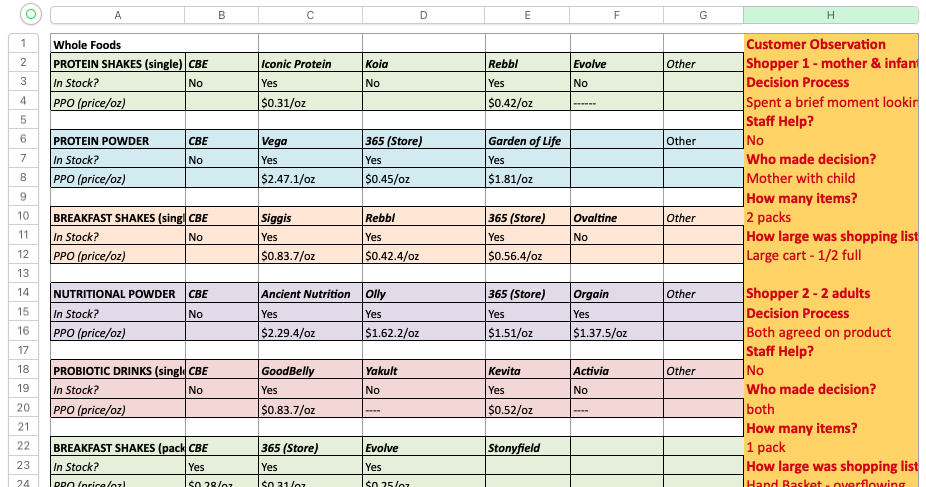

- Competitive Cost Analysis

-

- I assigned each team member a set number of stores for us to gather in-store product insights as well as observe buyer behavior within the breakfast aisles.

- 20 different stores categorized into store type

-

- Big Box Stores (Walmart, Target, etc.)

- Healthy Store Chains (Whole Foods, Trader Joe’s, etc.)

- Local Chains (Mariano’s, Fred Meyer, etc.)

- Neighborhood Stores (J&Js, Uptown Market, etc.)

-

- Observational Study

- As we gathered competitor cost, we observed buyer behavior with a focus in the following areas

- Decision process: Did they know what they wanted or did they compare products?

- Did they ask staff for help making a decision?

- Was it a guardian or child making the decision?

- How many items did they take?

- How large was their item list? (full hand basket, small cart, etc.)

- As we gathered competitor cost, we observed buyer behavior with a focus in the following areas

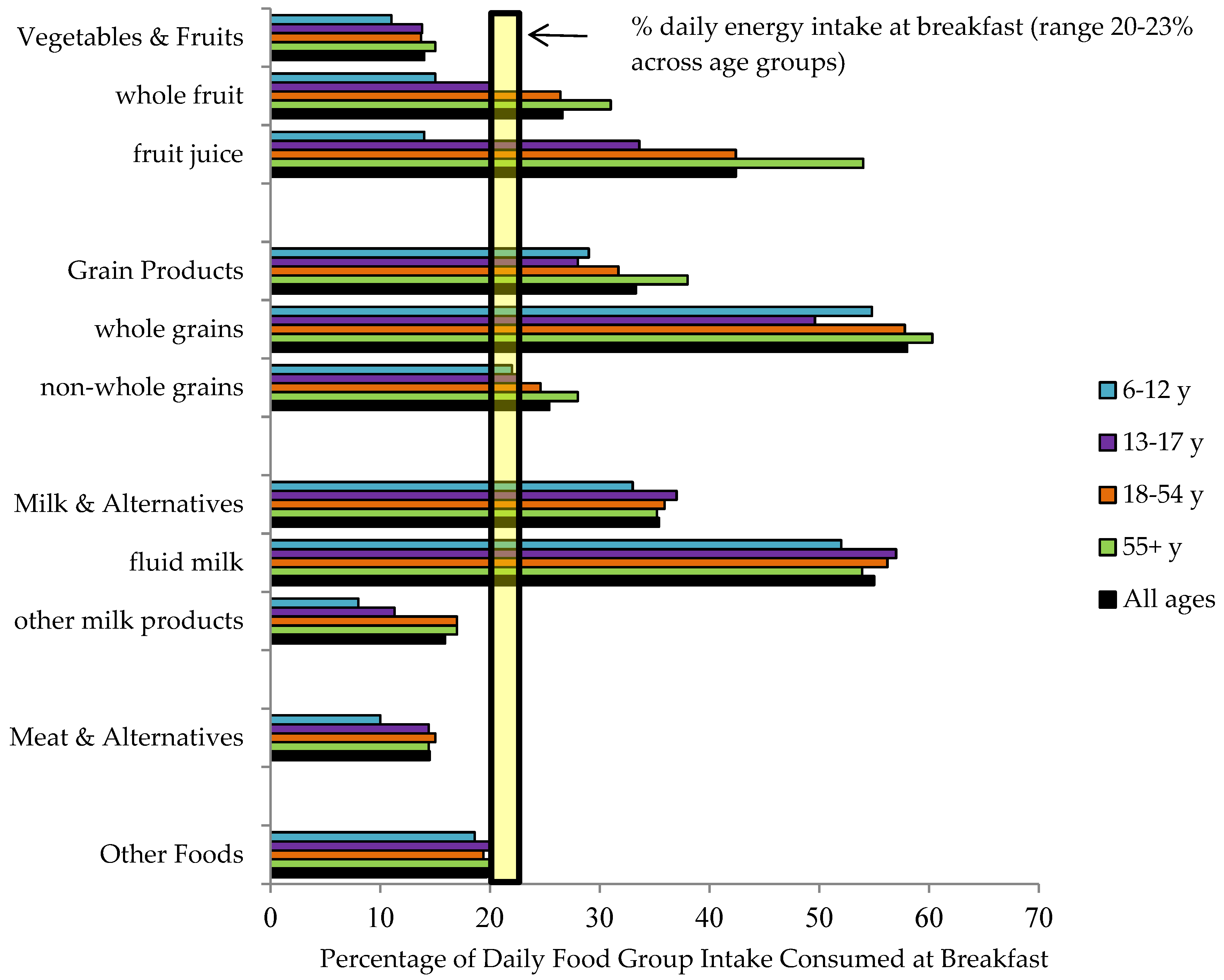

Market/Consumer Reports

I worked alongside an analyst to analyze year-over-year consumer reports, product category sales, and market trends for the past 5 years. We used third party market research companies such as, Nielson, IRI, Qualtrics, Forrester, and Gartner.

Final Reports

Presentation

The Nestle team flew in for a short week to taste test the final recipes as well as a final meeting to go over the research findings. The presentation was split between the owner (Mary) and myself for presenting. I was responsible for presenting Focus Group findings and field study insights.

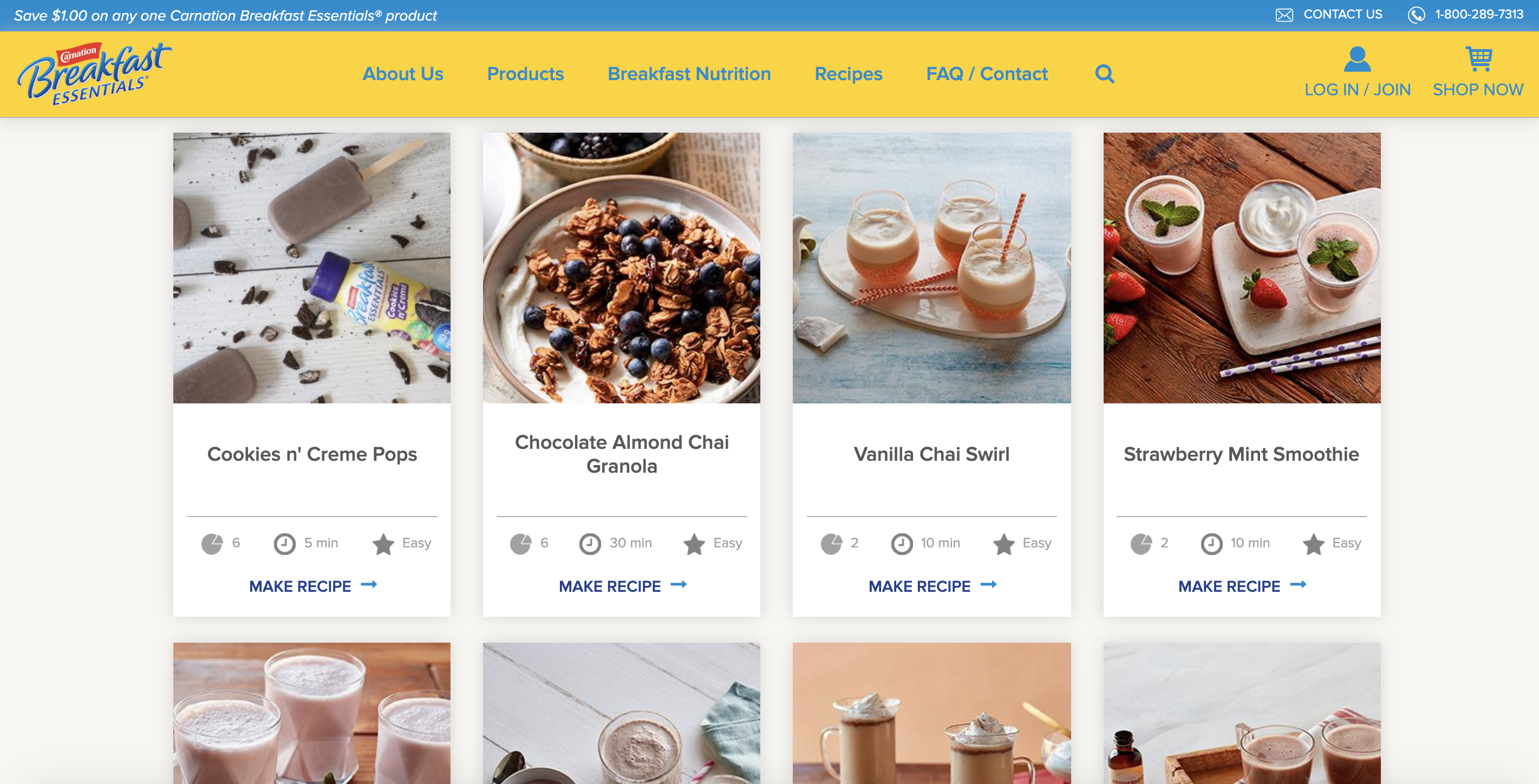

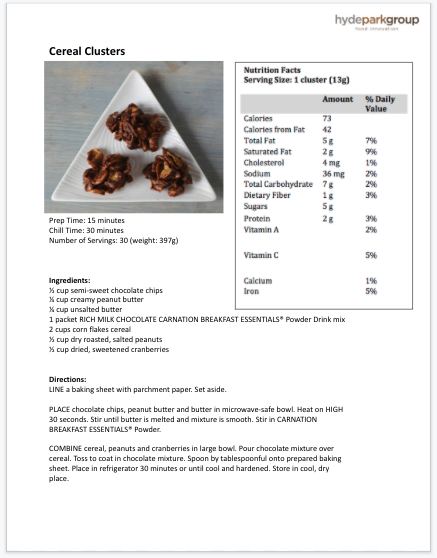

Final Recipes

I worked alongside a nutritionist at Nestlé to provide the recipe directions, amounts, and accurate nutritional facts based on serving size. The final 25 recipes were used to launch a recipe page on the Carnation Breakfast Essentials website. Nestlé also requested hi-res images of the recipes so they could begin digital marketing campaigns focusing on these recipes.